As was widely anticipated, the Bureau of Labor Statistics (BLS) annual revision revealed that their initial payrolls estimates overstated job growth. Large revisions have been common in the past and usually occur around periods of economic transition. The Federal Reserve is prioritizing labor over inflation. Could lower rates help keep housing costs in check? Who is paying the tariffs? AI Capex. A historic rally.

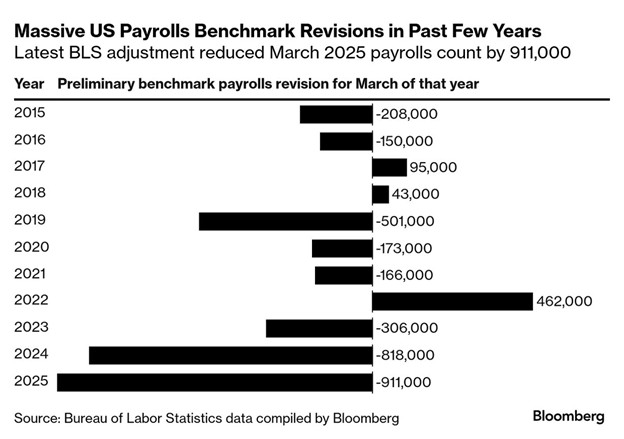

1. Large and consistent negative revisions are a concerning trend:

Source: Bloomberg Evening Briefing

Source: Bloomberg Evening Briefing

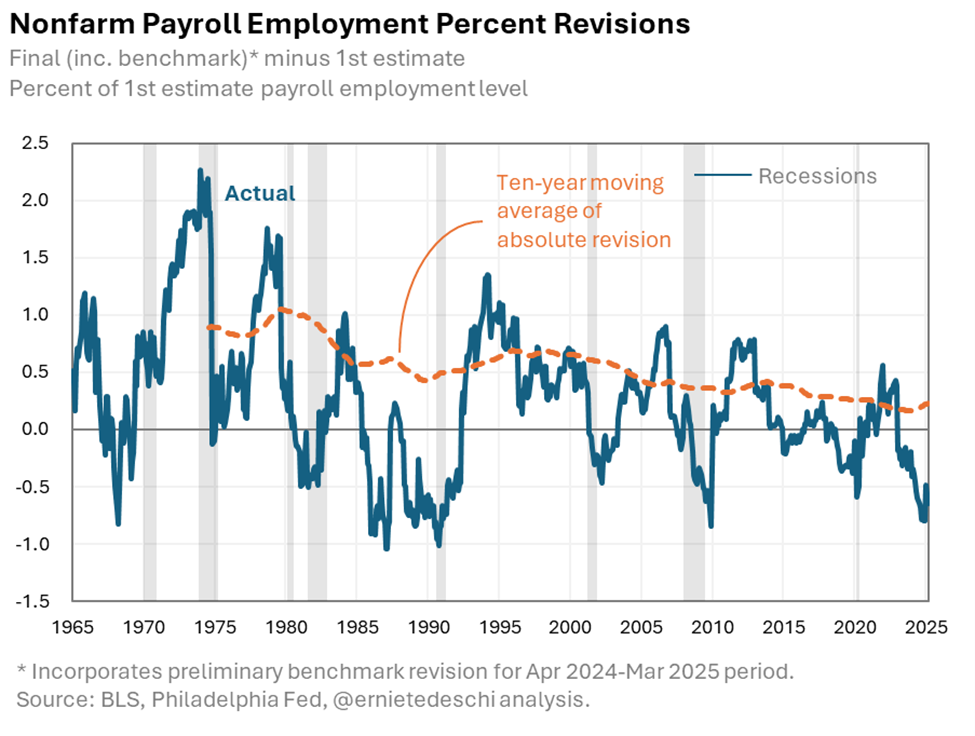

2. When the economy is accelerating or decelerating, the payrolls survey sample can become unrepresentative of the population:

Source: @ernietedeschi

Source: @ernietedeschi

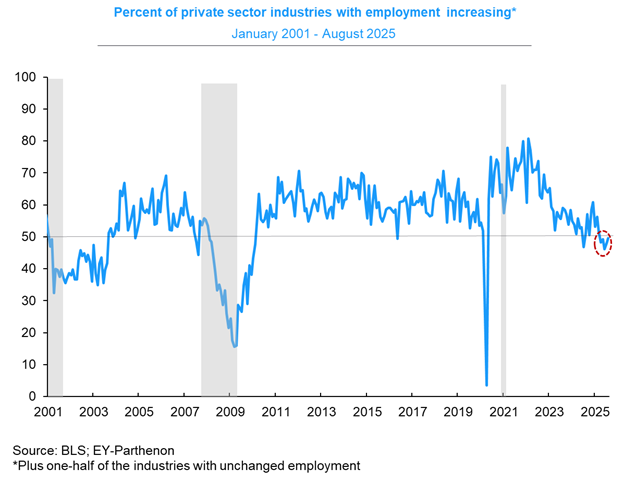

3. The labor market is at a tipping point. The Federal Reserve was faced with a similar picture when they began rate cuts last year:

Source: @gregdaco via the Daily Chartbook on 9/5/2025

Source: @gregdaco via the Daily Chartbook on 9/5/2025

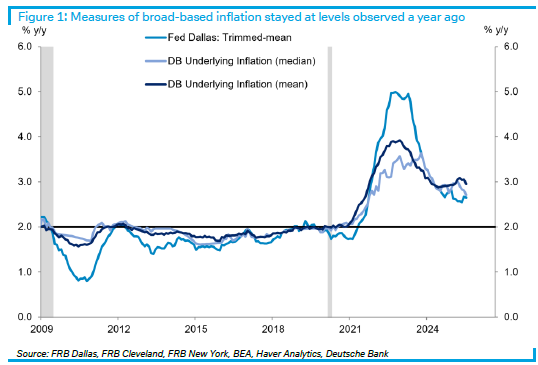

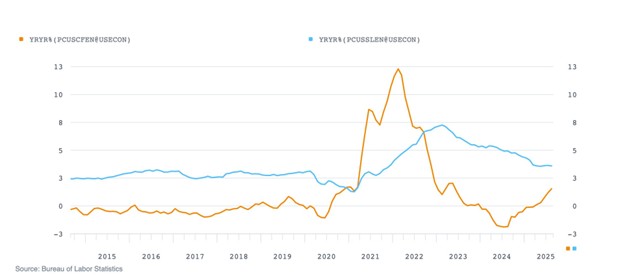

4. Inflation is currently running around 3% annually:

Source: John Authers, Points of Return

Source: John Authers, Points of Return

5. Core goods inflation (orange line) is rising while core services inflation (blue line) is no longer clearly falling:

Source: @greg_ip

Source: @greg_ip

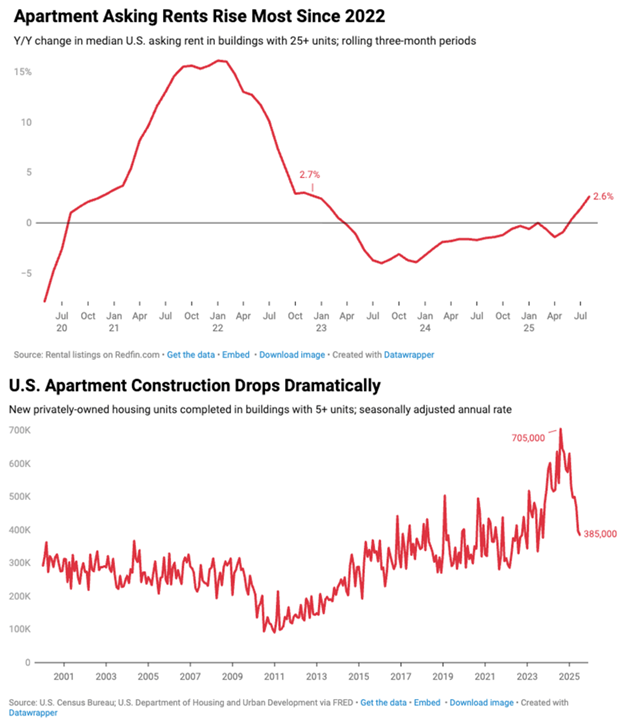

6. With multifamily completions past their peak, rents are edging higher again. Perhaps lower rates will spur more construction:

Source: Lily Katz, Redfin via the Daily Chartbook on 9/9/2025

Source: Lily Katz, Redfin via the Daily Chartbook on 9/9/2025

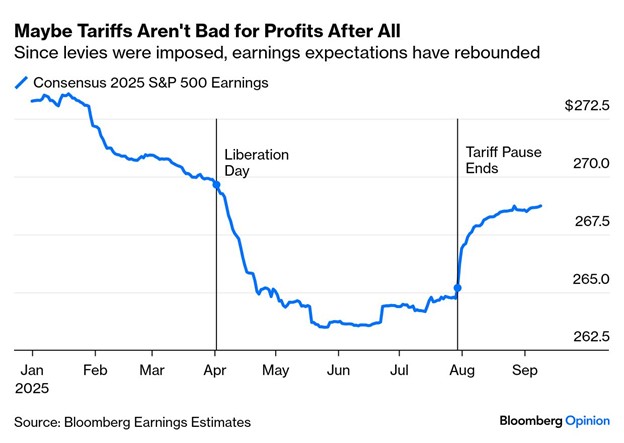

7. Analysts now expect a limited impact from tariffs on corporate profits:

Source: John Authers, Points of Return

Source: John Authers, Points of Return

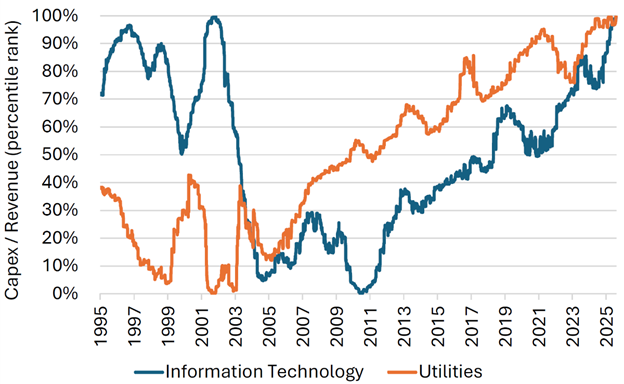

8. The capital intensity for the two sectors building AI infrastructure is as high as it’s been in decades:

Source: S&P Capital IQ and Verdad analysis

Source: S&P Capital IQ and Verdad analysis

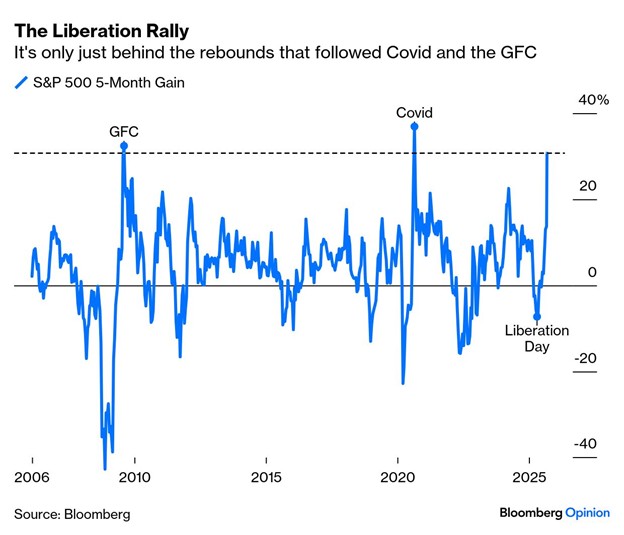

9. Prior to the current rally, the past twenty years have only seen gains of this magnitude in the wake of major economic shocks:

Source: John Authers, Points of Return

Source: John Authers, Points of Return

Disclosures:

Copyright © 2025 Algorithmic Investment Models LLC (AIM). All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Algorithmic Investment Models. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Algorithmic Investment Models.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

The charts and infographics contained in this blog are typically based on data obtained from third parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

The MSCI US ex Big Tech Index measures the performance of U.S. equities while excluding the largest technology companies to reduce concentration risk. The MSCI ACWI Index is a global equity benchmark covering both developed and emerging markets. The MSCI Japan Index captures large- and mid-cap representation across the Japanese equity market. The MSCI Asia Pacific ex Japan Index reflects developed and emerging market equities in Asia Pacific excluding Japan. The MSCI ACWI ex US Index tracks global equities excluding U.S. companies. The STOXX Europe 600 Index represents 600 large, mid, and small capitalization companies across 17 European countries. The S&P 500 Index is a widely recognized measure of U.S. large-cap equities across 500 leading companies. The MSCI China Index captures large- and mid-cap representation across Chinese equity markets. The MSCI Emerging Markets (EM) Index represents large- and mid-cap companies across emerging market countries. The MSCI UK Index tracks large- and mid-cap stocks within the United Kingdom equity market. The Personal Consumption Expenditures (PCE) Price Index measures inflation based on consumer spending in the U.S. The federal funds rate is the interest rate at which U.S. banks lend balances to each other overnight, set by the Federal Reserve as a key monetary policy tool.

Please contact your AIM Regional Consultant for more information or to address any questions that you may have.

Algorithmic Investment Models LLC (AIM), 125 Newbury St. 4th Floor, Boston, MA 02116 (844-401-7699)