There’s a Prediction Market for That?

What’s great about financial innovation in 2026 is that if you want to wager on the NFL playoffs, there’s a prediction market for that. If you want to bet on the next FED Chair, there’s a prediction market for that. And, if you want to predict the next country targeted by the U.S. military (at the time of writing, the front runner is Iran at 66%) there’s a prediction market for that, too.

I wonder if Steve Jobs would appreciate the technological leap and utility increase that prediction markets offer much like he did the iPhone in 2009…

Surprisingly, the PR surrounding prediction markets is not all sunshine and roses. Accompanying the adoption of these betting vehicles is an undercurrent of grift that is enabled by insider trading and manipulation. You have markets with very specific outcomes, people with material information that can control said outcomes, and a way to monetize that information in just a few clicks. Show me the incentive, and I’ll show you the outcome.[1]

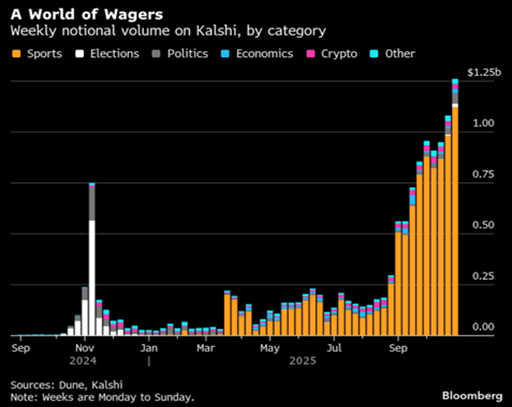

Ethical concerns and considerations aside, the incidence of insider trading can be viewed as a feature rather than a bug: the public wins by having access to more accurate forecasts from more informed market participants. However, I would wager that the most popular category for Kalshi and Polymarket by volume being sports is evidence that participants are largely viewing the platforms as gambling platforms, not as some impartial arbitrator of truth.

A Shift in Retail Risk-Taking

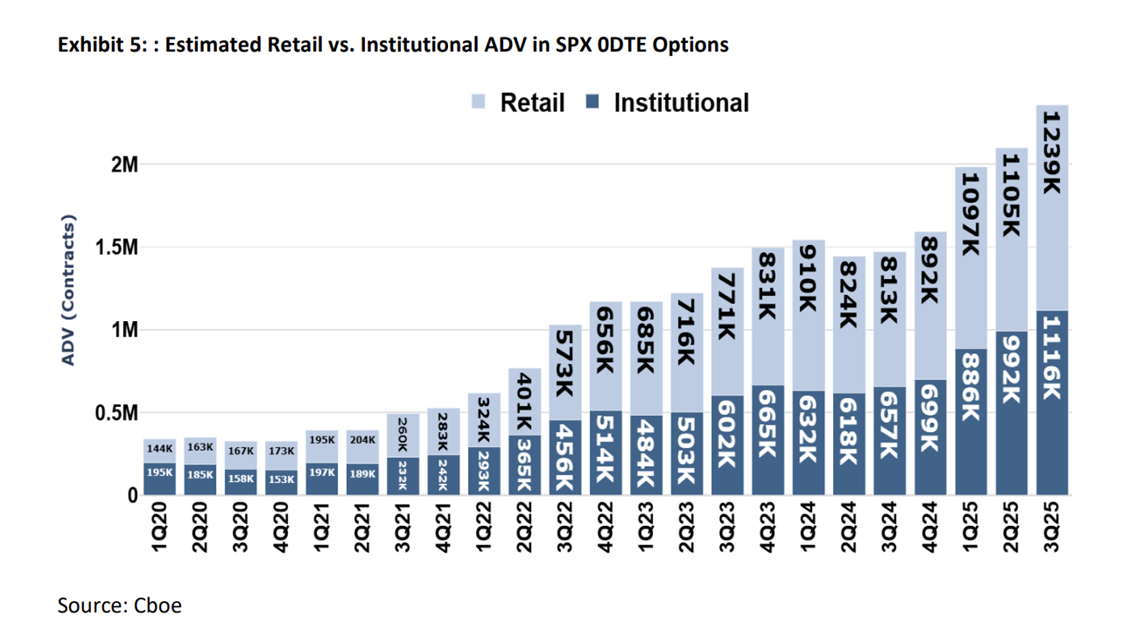

As a market analyst, I can’t help but notice that the rise of these prediction markets is just yet another contribution to the post-covid zeitgeist of financial gamification. Whether it be sports betting, crypto trading, or stock market activity, the incidence of retail participation has taken off and, with it, an all-or-nothing approach to risk. This is evidenced by these betting mediums being typified by their most extreme and riskiest products: multi-leg parlays, leveraged fartcoin, and 0DTE option trading.

Source: Cboe as of 9/30/2025

Source: Cboe as of 9/30/2025

These products are more akin to lottery tickets than stock market returns. This can seriously alter the dynamics of the stock market as typical analyses of value are thrown out the window and replaced with the idea of gambling on some extreme right-tail outcome. When one is accustomed to their bets going to 0, there may be an irrational lack of fear when one of their securities (also seemingly bets) declines. Conversely, when one is conditioned to chase outsized returns, there may be an irrational exuberance that results in them riding their winning hand much longer than they otherwise would.

The Spillover Effects on Public Markets

An interesting subtlety to this behavior in the stock market is that, unlike prediction markets or sports betting, there is no settlement date for one’s wager. This allows for the manufacturing of gains from pure belief. With enough belief these bets can become self-fulfilling. Evidenced by the GameStop saga in 2021, “fighting” this irrationality can be very costly. Consequently, the stock market starts to feel like a craps game where everyone is making money tailing the hot shooter.

This places investors in quite a predicament. Fighting the tide seems foolhardy, but riding the wave seems precarious with U.S. equity markets looking increasingly unaffordable.

Disclosures:

Copyright © 2025 Algorithmic Investment Models LLC. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Algorithmic Investment Models. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Algorithmic Investment Models.

Views and opinions expressed are those of the author as of the date of publication and are subject to change without notice. Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

The charts and infographics contained in this blog are typically based on data obtained from third parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

References to prediction markets, sports betting, or specific platforms are for illustrative and educational purposes only and do not constitute an endorsement, recommendation, or solicitation to participate in such activities. References to cryptocurrencies, leveraged instruments, or options are for illustrative purposes only. Such instruments involve substantial risk, including the potential loss of principal, and may not be suitable for all investors.

Algorithmic Investment Models LLC (AIM)

125 Newbury St., 4th Floor, Boston, MA 02116 (844-401-7699)

[1] This phrase is commonly attributed to the late Charlie Munger, longtime Vice Chairman of Berkshire Hathaway