What if technology companies ultimately aren’t the biggest beneficiaries of AI? Money has rotated out of the market leaders over the past month. The first post-shutdown inflation report was incomplete at best, yet encouraging nonetheless. Many economists are skeptical of the reported downshift in housing inflation, but it may not be far from reality. We’ve never seen a labor market quite like this one. Have international stocks finally turned the corner? Auto loan delinquencies.

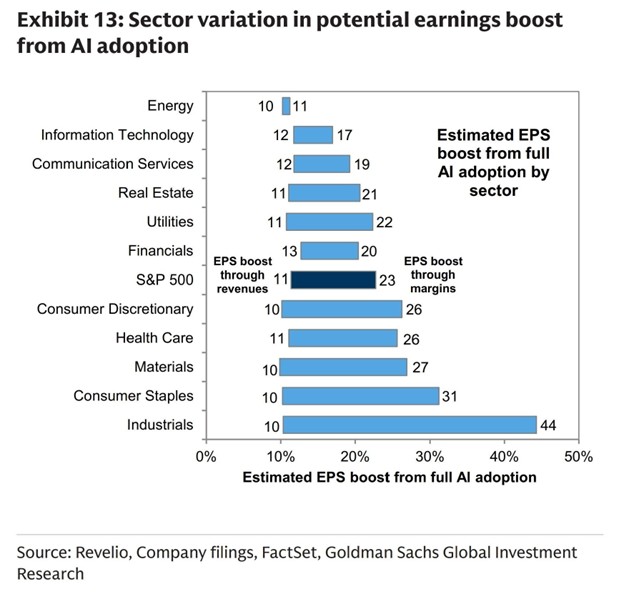

1. Consumer technology produced a lot of consumer surplus, perhaps AI will do the same but for businesses:

Source: Goldman Sachs, @wallstjesus via the Daily Chartbook on 12/12/2025

Source: Goldman Sachs, @wallstjesus via the Daily Chartbook on 12/12/2025

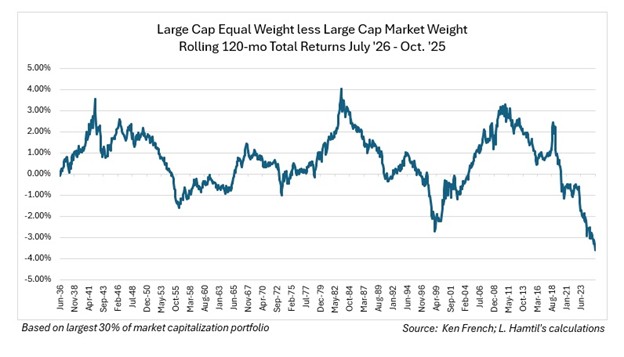

2. Heretofore, the market has rewarded the largest companies disproportionately:

Source: @lhamtil

Source: @lhamtil

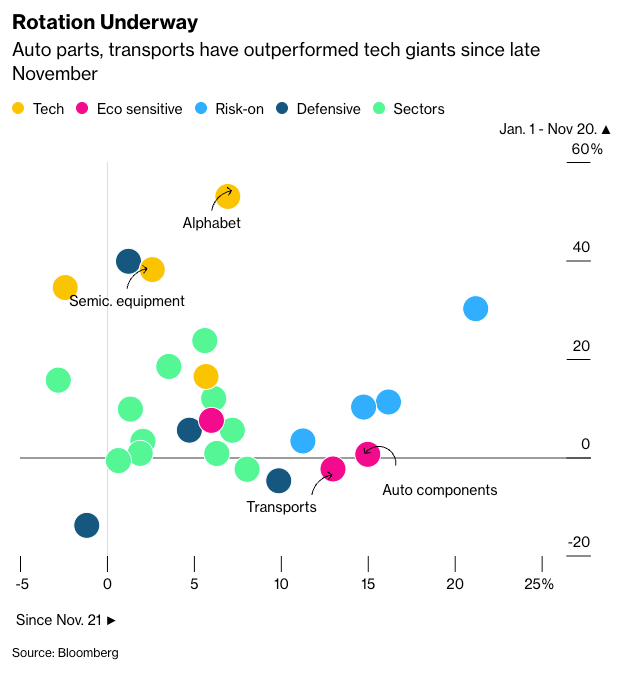

3. Money is rotating into “Risk-on” and “Eco sensitive” areas of the market:

Source: Alexandra Semenova, Bloomberg via the Daily Chartbook on 12/15/2025

Source: Alexandra Semenova, Bloomberg via the Daily Chartbook on 12/15/2025

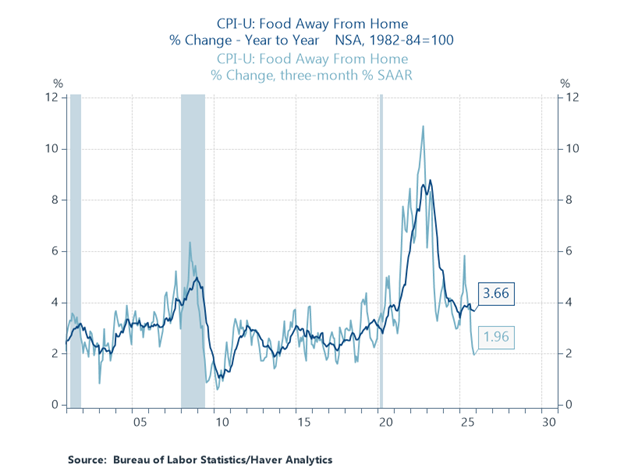

4. To quote Renaissance Macro, “Food away from home (FAFH) inflation is moderating quite a bit. This is a good measure of underlying inflation pressure since restaurants bundle food, labor and rents into their menu prices:”

Source: @RenMacLLC

Source: @RenMacLLC

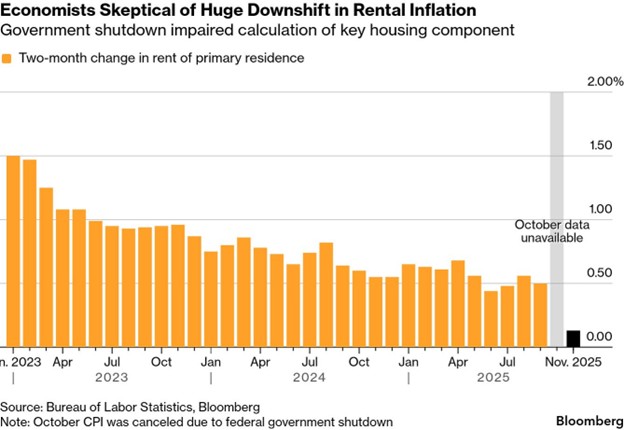

5. It seems unlikely that housing inflation, as the BLS measures it, slowed this quickly:

Source: Bloomberg Markets Daily

Source: Bloomberg Markets Daily

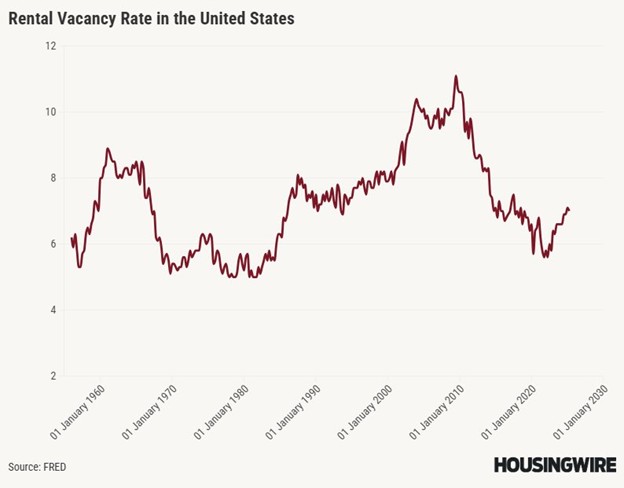

6. That being said, rental vacancies have been on the rise so it’s unlikely there’s much price pressure:

Source: @LoganMohtashami

Source: @LoganMohtashami

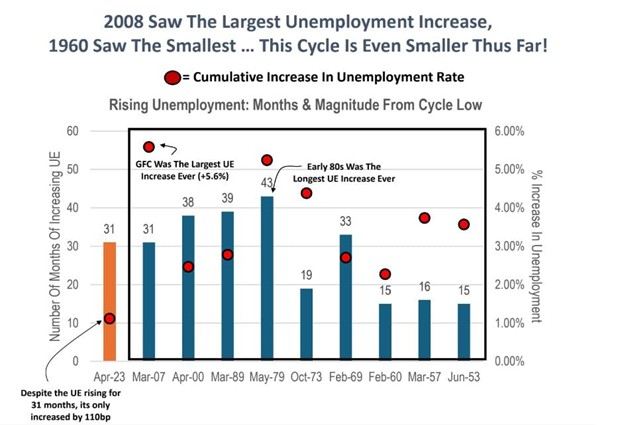

7. Conventional wisdom says that once the unemployment rate starts moving higher it tends to accelerate but, so far, that hasn’t happened:

Source: @michaelkantro, h/t @financeowl1 via the Daily Chartbook on 12/19/2025

Source: @michaelkantro, h/t @financeowl1 via the Daily Chartbook on 12/19/2025

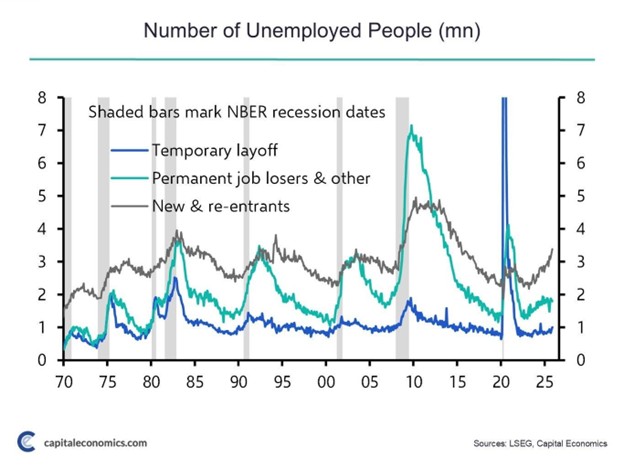

8. More evidence of a no hiring, no firing labor market:

Source: @economy_steve via the Daily Chartbook on 12/16/2025

Source: @economy_steve via the Daily Chartbook on 12/16/2025

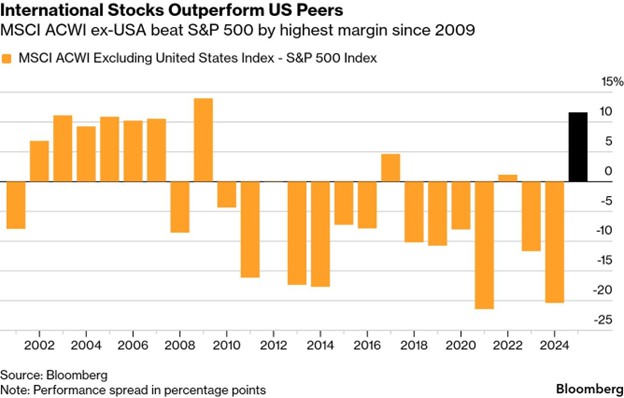

9. 2026 was the best year for international stocks, relative to U.S. ones, in over a decade:

Source: Bloomberg Markets Daily

Source: Bloomberg Markets Daily

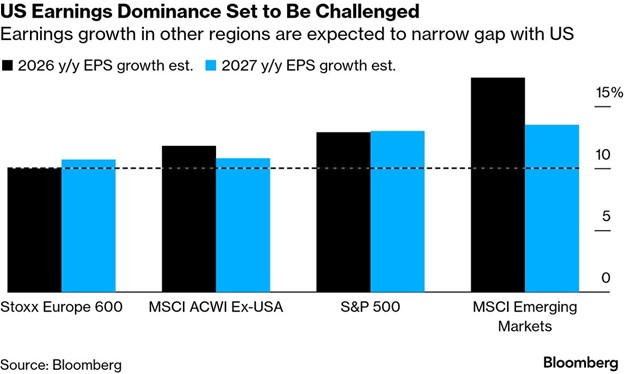

10. For the strong performance to continue, international companies will likely have to follow through on projected earnings growth:

Source: Bloomberg Markets Daily

Source: Bloomberg Markets Daily

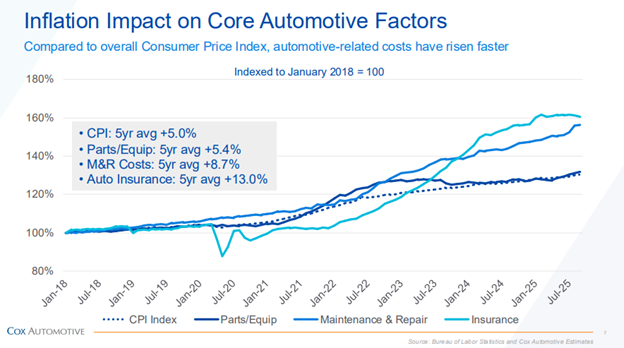

11. An interesting observation from Joe Weisenthal of Bloomberg’s Odd Lots is that unexpected increases in insurance costs may be a key factor behind rising auto loan delinquencies:

Source: Cox Automotive via Bloomberg Odd Lots

Source: Cox Automotive via Bloomberg Odd Lots

Disclosures:

Copyright © 2025 Algorithmic Investment Models LLC (AIM). All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Algorithmic Investment Models. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Algorithmic Investment Models.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

The charts and infographics contained in this blog are typically based on data obtained from third parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

A Z-score is a statistical measure that indicates how many standard deviations an observation is above or below the mean of a data set. The 10-Year Treasury Yield represents the interest rate on U.S. government debt securities with a maturity of ten years and is commonly used as a benchmark for long-term interest rates. The Fed Funds Rate is the target interest rate range set by the Federal Reserve at which depository institutions lend reserve balances to each other overnight. The 30-year fixed mortgage benchmark reflects the average interest rate charged on a 30-year fixed-rate residential mortgage in the United States. The 30-Year Treasury Yield represents the interest rate on U.S. government debt securities with a maturity of thirty years and is often used as a benchmark for long-term borrowing costs. Core CPI measures changes in the prices paid by consumers for goods and services excluding food and energy, which are considered more volatile.

Please contact your AIM Regional Consultant for more information or to address any questions that you may have.

Algorithmic Investment Models LLC (AIM), 125 Newbury St. 4th Floor, Boston, MA 02116 (844-401-7699)