Recently the SEC halted its review of highly levered ETFs in a signal they may be attempting to curb this burgeoning asset class.

Tuttle Capital, the firm who rose to prominence from the release of its 2x MicroStrategy ETF, got the ball rolling in early October when they filed for 59 new 3x single stock ETFs under the RexShares banner[1], further cementing their position at the apex of product innovation. Shortly after a fury of competitors followed, all perhaps hoping to capitalize on a dark period of regulation during the recent government shutdown.

While the flood may be stemmed for now, there are already a staggering number of levered ETFs in the market. These ETFs have the potential to provide real value to short-term traders, especially those who cannot access cheap margin or are afraid of being margin-called, but they come with significant costs. While these ETFs generally deliver on their advertised daily returns, over time the combination of their implementation costs and volatility create a significant drag on performance.

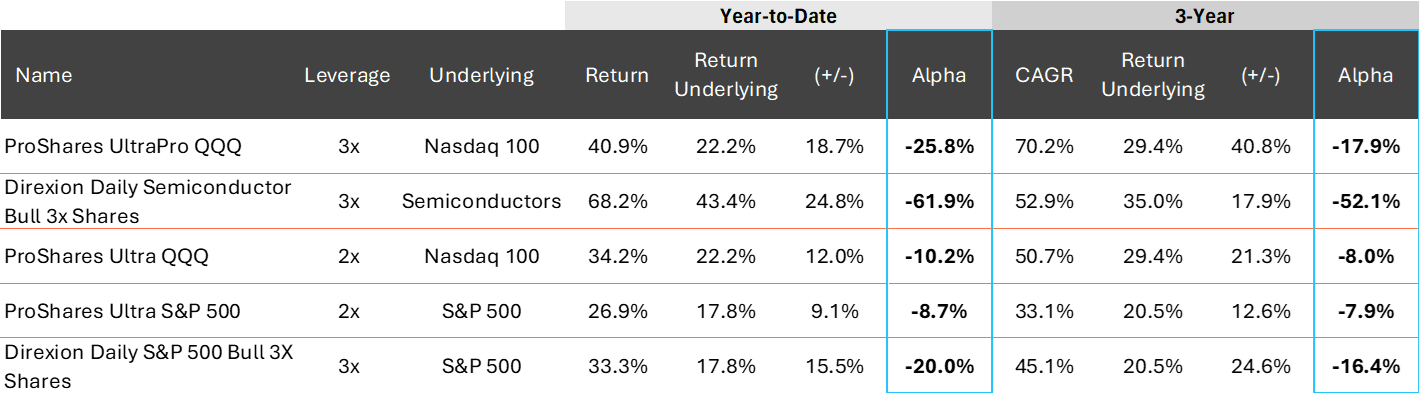

It is easy to see why investors have a strong appetite for these products as the returns for the largest 5 levered index ETFs (by AUM) have generally been staggering in the recent market environment:

Source: Bloomberg, 1-year return data from 12/31/2024 – 12/3/2025. 3-year return data from 12/4/2021 – 12/4/2025. For illustrative purposes only.

Source: Bloomberg, 1-year return data from 12/31/2024 – 12/3/2025. 3-year return data from 12/4/2021 – 12/4/2025. For illustrative purposes only.

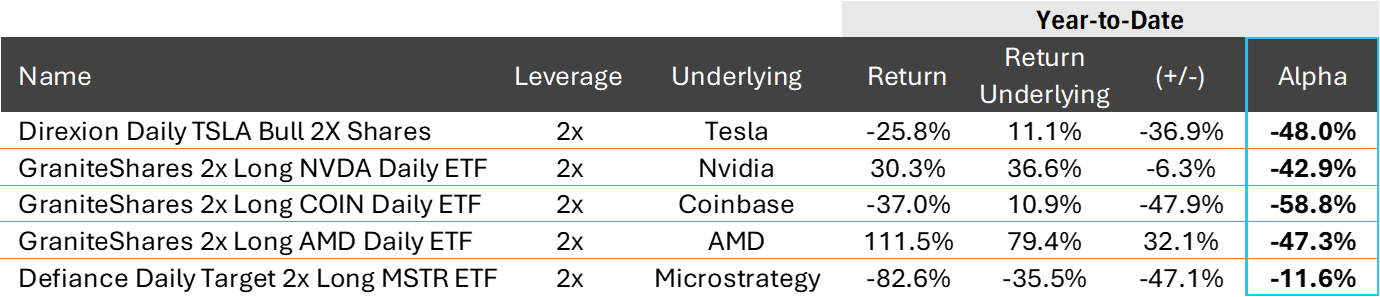

In the past, levered ETFs like the ones above have been reserved for large index-like asset classes which typically don’t exhibit outsized volatility before additional leverage is applied. Even so, when adjusting for their Beta (Risk!) to the underlying, underperformance appears to have been quite strong and consistent, implying relatively dire consequences in a weaker market. It is likely many investors are aware of this drag and are happy to “pay” in exchange for the leverage, but once this leverage gets applied to already volatile assets such as single stocks the costs become far more burdensome.

Here’s the data from the 5 largest single stock ETFs (by AUM) over the last year:

Source: Bloomberg, 1-year return data from 12/31/2024 – 12/3/2025. For illustrative purposes only.

Source: Bloomberg, 1-year return data from 12/31/2024 – 12/3/2025. For illustrative purposes only.

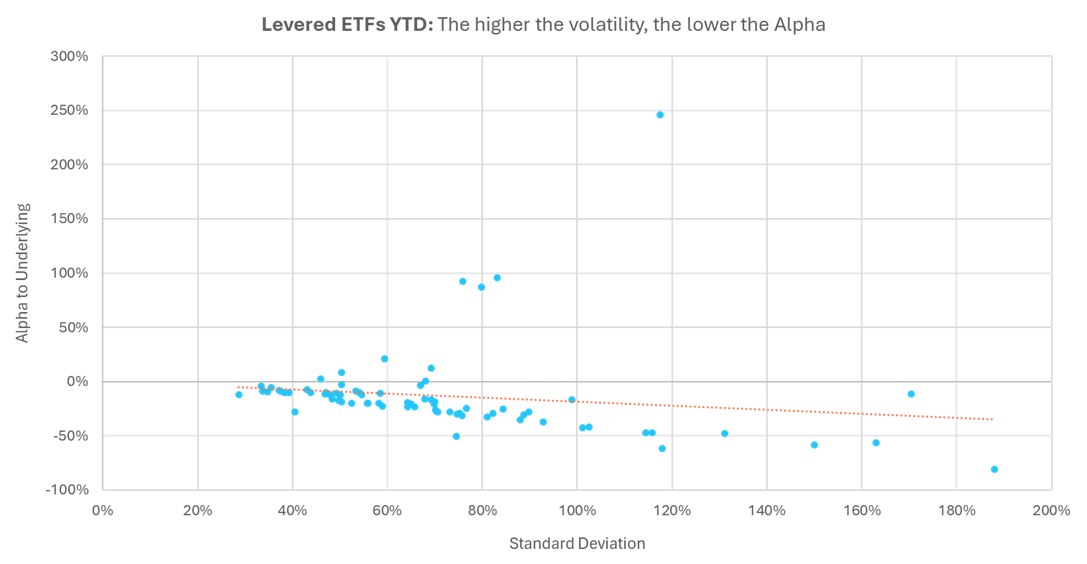

There appears to be a “speed limit” on volatility which most of these new ETFs are exceeding as they apply leverage to what are already the most “exciting” securities in the market. When reviewing the performance of the 100 largest levered ETFs (by AUM) there is a clear, strong, negative relationship between alpha and volatility.

Source: Bloomberg, 12/31/2024 – 12/3/2024. For illustrative purposes only.

Source: Bloomberg, 12/31/2024 – 12/3/2024. For illustrative purposes only.

While it is good to see the SEC looking out for investors, it is clear this category of products presents a new and enticing risk for investors and should be approached with a high degree of caution. It will be interesting to see if the increasing access to leverage via ETFs will cause more volatility for the type of assets these recently launched ETFs are targeting. Crypto markets have recently highlighted the risks of leverage on already volatile assets[2] as forced liquidations from brokers in the space have accelerated a large drawdown. If investors flee the levered ETF space during a period of stress those ETFs own selling or lack of buying may exacerbate the moves of their underlying assets.

[1] https://x.com/EricBalchunas/status/1975537558194106807

[2] https://www.theinformation.com/articles/borrowed-money-fueled-cryptos-700-billion-sell?utm_campaign=article_email&utm_content=article-15894&utm_medium=email&utm_source=sg

Disclosures:

Copyright © 2025 Algorithmic Investment Models LLC. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Algorithmic Investment Models. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Algorithmic Investment Models.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

The charts and infographics contained in this blog are typically based on data obtained from third parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

Investing in leveraged ETFs involves significant risks, including the potential for magnified losses, compounding risk (volatility drag) over periods longer than a single day, the possibility of losing money even if the underlying index increases in value, and is generally unsuitable for “buy-and-hold” investors. These products are complex financial instruments that require active monitoring and a thorough understanding of all associated risks prior to investment.

Please contact your AIM Regional Consultant for more information or to address any questions that you may have.

Algorithmic Investment Models LLC (AIM)

125 Newbury St., 4th Floor, Boston, MA 02116 (844-401-7699)