Before we dive into this quarter’s letter, I just wanted to remind you that the second edition of our newsletter, Un-Herd, is coming out tomorrow morning! To see what its all about and/or get this right to your inbox, click here!

Okay now lets get into it…

Stock markets are at all-time highs, public companies are shutting down their operations to buy bitcoin, consumers can bet in real time on almost anything they can imagine, “meme stocks” are back in full force, even the US government is buying stocks. And yet consumer sentiment is at levels never before seen outside of a recession, nearly matching the depths of 2008. What gives?

The easy way to reconcile this would be to say social media and smartphones have slowly rotted our brains – accelerated by the pandemic. This has made people generally more upset or at least less optimistic about how they shape up versus others.[1] While I still think this is probably the best explanation, I’d like to explore an alternative: The aggregate economy is not a great representation of the average individual’s economic circumstances.

The economy is weakening. Jobs are harder to come by, prices remain stubbornly high with the prospect of increasing, and the AI threat looms over the white-collar workforce – threatening to turn everyone into batteries as power for its ever-expanding data center empire.

The asset economy, alternatively, has never been stronger. The ratio of wealth to income has increased rapidly in the United States, and the top 10% now represent almost 50% of all consumption.[2] The owners of assets are increasingly determining the trajectory of the broad economy. We’ve transitioned, on the margin, from a paycheck economy to a portfolio economy.

Normally risk-on environments are a result of confidence in one’s economic condition with a healthy dose of FOMO. I would argue the risk appetite we are seeing in markets now is due to FOFB (fear of falling behind) as ownership of assets appears increasingly important for financial security.

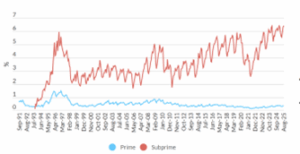

Perhaps this is all great news as stocks are at an all-time high, and recent data from Visa suggests a $1 increase in wealth now translates to $0.35 in economic spending, up dramatically from the $.09 they estimated in 2017.[3] Strong markets can continue to power the aggregate economy. Meanwhile the lower end consumer is showing signs of strain. Sub-prime auto loan delinquencies are reaching levels that have historically been cause for major concern[4] and for the first time in years the average FICO[5] score ticked down. If this strain materializes as a true credit problem it could be strong enough to overcome the market on its own, but more likely, the economy goes as the market goes in the near term.

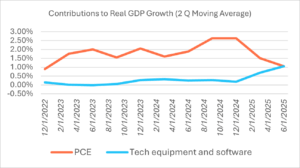

So, the Economy is tied to the stock market, and the stock market is seemingly tied to AI. To be fair, AI is also boosting the real economy directly, contributing as much to GDP growth in the first two quarters as all of consumer spending.[6] The AI trade is really important. It’s a huge weight in the S&P 500 and global indices. It is starting to look pretty crazy.[7] Demand for future AI products is relatively unknown and yet massive capital, often with long-term commitments, is being doled out with reckless abandon. Historically, capital spending binges well ahead of demand have ended poorly, even when that demand is ultimately very large, just like it was for internet infrastructure in the dotcom era. Recently, the financing has become increasingly creative, with various counterparties making circular agreements with one another to help fund the growth. According to various reports and announcements, the company that “lit the match” on the AI frenzy – OpenAI – is set to lose something like $8B (estimate) this year, already has outstanding commitments in the range of $400-500 Billion for infrastructure over the coming years, and doesn’t expect to turn a profit until the end of the decade.

What’s a few billion between friends?

It is a near certainty that all of this AI-related spend will be a huge benefit to society in the future—providing ample compute and even potentially cheap energy if demand ultimately falls short of expectations. In the near-term though, the returns on capital look risky.

Stocks for the short run?

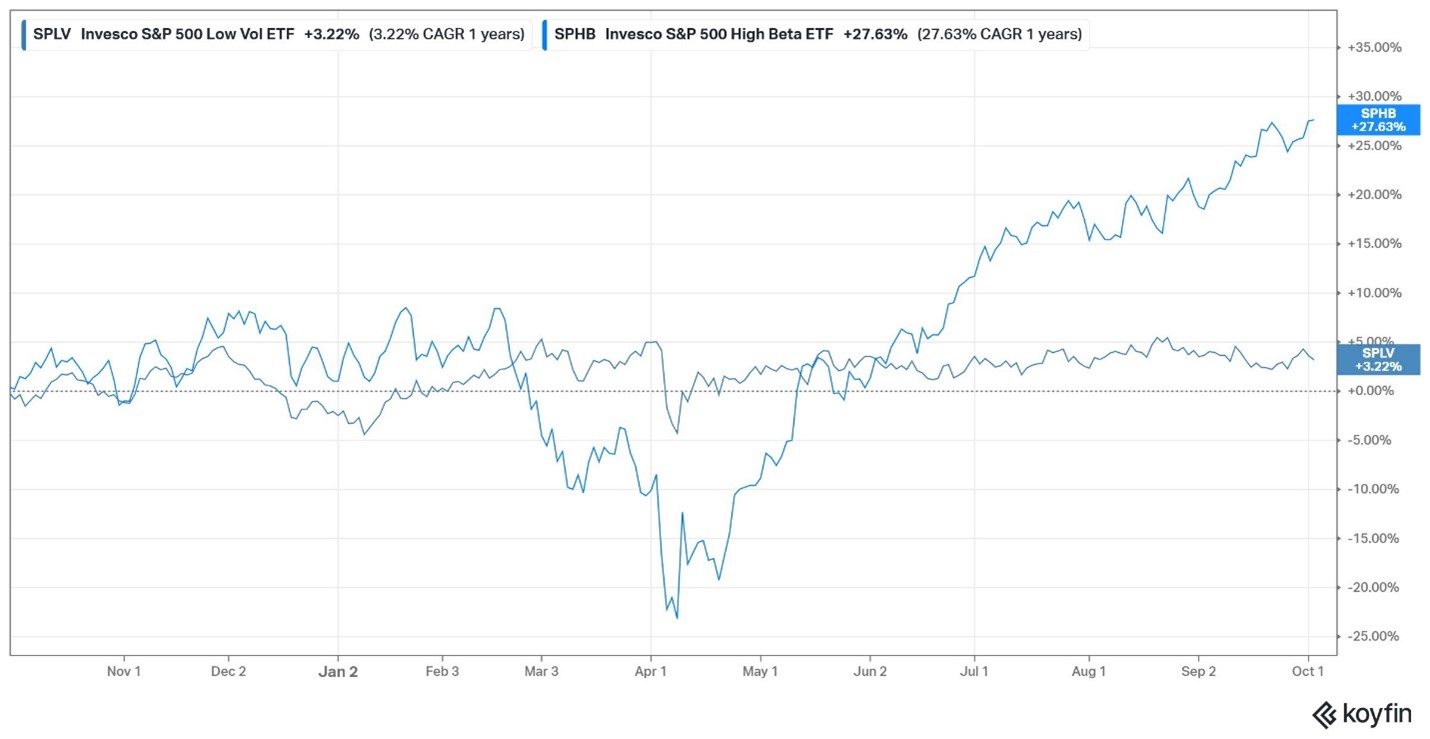

What about lower rates? There is a strong case that a “run it hot” economy forces investors to own assets. Lower discount rates with strong growth and inflation are a great environment for assets. The market agrees, as the late surge in the riskiest of assets in Q3 corresponded with the Federal Reserve cutting short-term rates.

Rate Cuts Fuel Risk Appetite

Source: Koyfin, 9/30/2024 through 9/30/2025

Source: Koyfin, 9/30/2024 through 9/30/2025In addition, the world’s longest tenured inflation hedge, Gold, has been on a historic run and the dollar has continued to weaken – providing a tailwind for foreign assets.

One area where lower rates might provide an actual economic boost is housing. Turnover in the housing market remains historically low. However, longer-term rates, like those which drive mortgages, are only loosely influenced by the federal reserve and have not declined much so far. Given that higher rates didn’t materially impact anything but the most interest rate sectors as rates increased (most notably housing, but also autos and other highly financed consumption), it isn’t obvious to us that lower rates should spur material economic growth as the cycle reverses.

So, what do you do?

It’s easy to see the predicament here. The market and economy look quite risky, but there is a lot of pressure to continue to own risk assets in the face of hotter monetary policy and seemingly limitless AI demand. It may not be a sexy answer, but diversification is likely the best course of action.

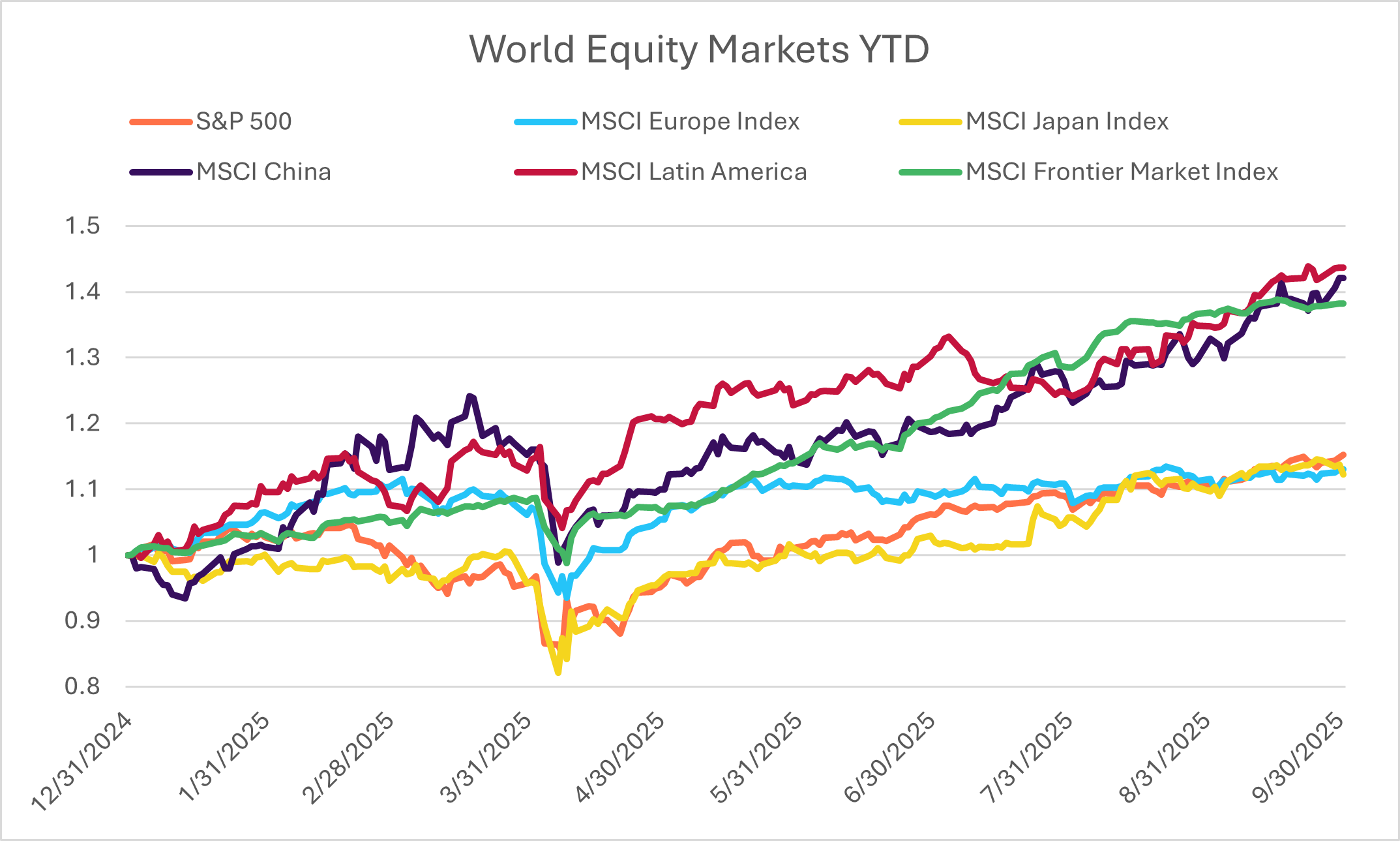

Our quantitative strategies have no direct knowledge of any of these fundamental circumstances. They have increasingly had a less favorable view of the long-running market leaders which had been the core of our portfolios for most of our history. It is likely that the backward-looking returns of these assets appear anomalously high, and there may be a wider range of other attractive options than there have been in the past, namely in foreign markets. Foreign markets aren’t driven by the AI trade and as a result aren’t beholden to it. For developed markets, increased fiscal stimulus has the prospect of increasing economic growth while the emerging markets are highly sensitive to dollar strength – a weaker dollar has been a massive tailwind for them. Diversification feels unnecessary or even painful when speculation and risk appetite are strong, but we believe it remains the best defense for uncertainty and risk. Two things which are not in short supply in our eyes.

It is hard to see the combination of an increasingly financialized economy, a concentrated stock market, and a weakening labor market with higher inflation as a sustainable situation – even if the path of least resistance is more of the same in the near-term. This has us personally quite cautious, but also excited that the prospects for tactical investment management, particularly the ability to diversify outside the U.S., might have an extended period of significant value-add to a traditional portfolio just as they have historically when prevailing leadership ultimately waned.

If you have question on how to position your portfolio for everything we just discussed, contact us! Below is a “quick and dirty” take on the portfolios positioning in the context of the markets from the third quarter.

Quarterly Notes from the PM Team

- There has been an increasing number of opportunities outside of the small group of securities driving most of the index return. Our most aggressive model has capitalized on this the most, but we are seeing increased equity across all risk levels.

- Aside from a timely semiconductors trade in our growth strategy, our portfolios had minimal exposure to US Growth equities. It has been difficult for our lower risk strategies to keep up in this environment.

- Our portfolios have indirect exposure to the AI capital cycle through Industrials and Energy-related equities, both of which provide the necessary backbone for the AI datacenter boom.

- Notably, our strategies have continued to increase their exposure to foreign markets.

- International markets have almost universally outperformed the U.S. on the year, with Dollar and commodity sensitive emerging markets leading the charge.

- Foreign equities offer lower valuations, stand to benefit from increased government spending, and are less dependent on the concentrated AI trade — a sharp contrast to the U.S. market.

- America first?

Source: Bloomberg, 12/31/2024 through 9/30/2025. Total return indices for S&P500, MSCI China, MSCI Europe, MSCI LatAm, MSCI Japan, and MSCI Front Markets.

Source: Bloomberg, 12/31/2024 through 9/30/2025. Total return indices for S&P500, MSCI China, MSCI Europe, MSCI LatAm, MSCI Japan, and MSCI Front Markets.

- “Running it hot” is now the dominant economic theme as monetary policy loosens in the face of rising and above target inflation.

- Inflation remains stubbornly high for services and, due to tariffs, there’s no countervailing offset from goods deflation.

- We believe the full impact of tariffs is yet to come. Thus far companies have absorbed the tariffs, but as certainty around their permanence increases we expect consumers, rather than shareholders, will foot the bill.

- We believe this will have the effect of forcing investors into assets, particularly those which should keep up with inflation.

- Recent data has further confirmed our notion that “wealth effects” are a larger part of the economy than ever before.

- Anemic hiring and rising delinquencies in consumer credit suggest growing strain in the economy.

- The wealthiest Americans are now responsible for 50% of all consumer spending, fueled by higher asset values. Portfolios are typically more volatile than paychecks and with markets increasingly reliant on the AI trade, any slowdown in the AI spending narrative could have far-reaching effects.

- The AI-fever is increasingly worrisome, echoing the investment frenzy of the dotcom era.

-

- The largest, most successful firms in the world (The Magnificent Seven) are investing record sums in competition with each other, a stark contrast to the behavior which made them magnificent, in fear of missing out on the next big thing.

- There is a “Data Center Gold Rush” in the works, sweeping up nuclear energy stocks and data center players, both startups and established players, much of it is now debt fueled. Some financial firms are lending billions to finance these projects, taking NVidia GPUs as collateral – Yikes!

- If this spending proves unnecessary, we might see an economic quake similar to the dotcom collapse, even if consumers and companies make great use of AI

[1] “Small pond theory” – Social media has allowed every fish to swim in a giant ocean. Individuals may have been very content in their smaller ponds until they saw just how well some other fish are living (or appear to be living).

[2] Source: Bloomberg. “Top 10% of Earners Drive a Growing Share of US Consumer Spending”. Sept 16, 2025.

[3] https://usa.visa.com/partner-with-us/visa-consulting-analytics/economic-insights/the-sudden-increase-in-the-wealth-effect-and-its-impact-on-spending.html

[4] https://www.fitchratings.com/structured-finance/abs/auto-indices#u.s.-auto-indices

[5] https://www.fico.com/en/resource-access/download/55026. Interestingly the top scores increased while the bottom decreased resulting in a lower average, but higher median.

[6]Bloomberg data from 12/31/2022-6/30/2025. Contribution to Real GDP for Tech Equipment and Software and Personal Consumption Expenditures.

[7] Dot-Com Déjà Vu: Oracle’s $300 Billion AI Bet Feels Familiar: https://algomodels.com/dot-com-deja-vu/

Disclosures:

Copyright © 2025 Algorithmic Investment Models LLC. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Algorithmic Investment Models. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Algorithmic Investment Models.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

The charts and infographics contained in this blog are typically based on data obtained from third parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

The S&P 500 Index measures the performance of 500 large U.S. companies across various industries and is weighted by market capitalization, giving larger companies greater influence on the index. The MSCI China Index measures the performance of large- and mid-cap companies across Chinese markets, including both onshore and offshore listings. The MSCI Europe Index captures large- and mid-cap representation across 15 developed European countries, reflecting the region’s diverse economies. The MSCI Latin America (LatAm) Index represents large- and mid-cap companies across key Latin American markets such as Brazil, Mexico, and Chile. The MSCI Japan Index tracks large- and mid-cap stocks in Japan’s equity market, providing a gauge of its industrial and consumer-driven economy. The MSCI Frontier Markets Index includes smaller, less-developed equity markets that are in earlier stages of economic and financial market development than emerging markets.

Please contact your AIM Regional Consultant for more information or to address any questions that you may have.

Algorithmic Investment Models LLC (AIM)

125 Newbury St., 4th Floor, Boston, MA 02116 (844-401-7699)